The Operations Registration System (SRO) is an important tool used by the Private Insurance Superintendence (Susep) for the control and inspection of operations carried out in the market with the provision of data sent by companies registered as registrars of insurance, open private pension, capitalization and reinsurance operations in Brazil.

Resolution CNSP 383/2020 instituted and established the guidelines for the SRO in the (re)insurance market where it was defined that the mandatory registration of operations should start within a maximum period of 3 (three) years from its publication. However, in January 2023, three important circulars were published that dealt with different aspects related to the system. Circular Susep nº 686/2023 establishes the conditions for the registration of financial assistance operations of open private pension entities and insurance companies; SUSEP Circular No. 687/2023 amends Susep Circulars No. 655/2022, 673/2022, 675/2022 and 679/2022, providing for new deadlines and, Circular Susep n.º 688/2023 amends Circular n.º 635/2021, which deals with the implementation of Open Insurance.

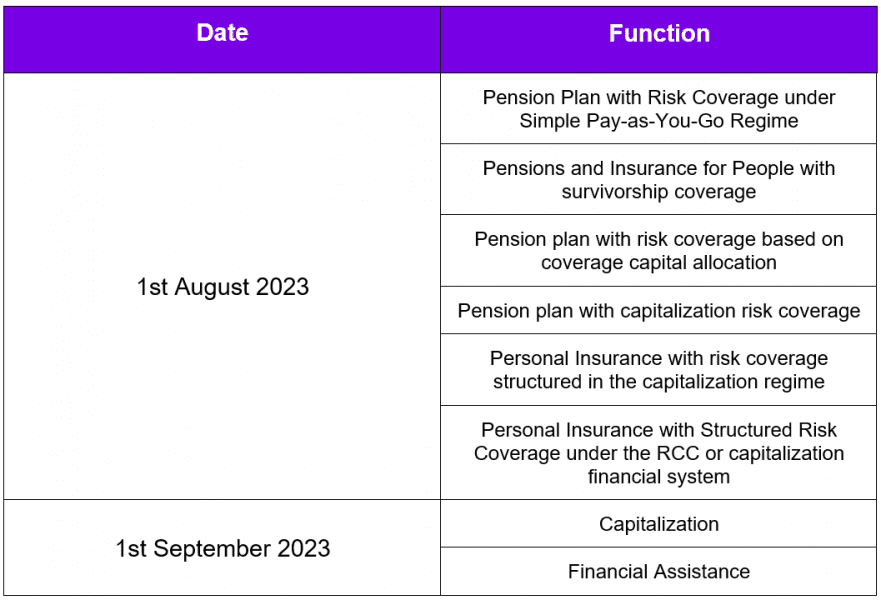

Regarding operations involving the People group and Open Supplementary Pension Entities, it is important to pay attention to the date on which the mandatory registration will come into force. Below is a list of operations that will soon be subject to this registration requirement:

It is important to highlight that SUSEP Circular nº 687/2023 follows these provisions in its amendments:

- Operations with coverage in force on August 1, 2023, must be registered within 30 (thirty) business days from the date of commencement of the obligation.

- Transactions with the coverage period ending on or before August 1, 2023, must be registered within 10 (ten) business days of the first financial transaction occurring after that date.

- In the case of pension operations with collective contracts and certificates of participants with events reported and not yet paid/settled by the mandatory date, or operations related to policies and individual certificates with reported claims, due income or premiums not financially settled until the mandatory date, the registration must be made within 20 (twenty) business days from this date.

- With regard to capitalization operations: a) they will comply with the same terms if effective on September 1, 2023 or closed at this date; and, b) if they have contemplated draws, requested redemptions or with contributions not paid financially until the date of initiation of the obligation, they must be registered within 20 (twenty) business days from September 1, 2023.

Lefosse’s Insurance, Reinsurance and Private Pensions Team closely monitors the changes that impact the sector. For further clarification on this matter, or others that may be of interest to you, contact our professionals.